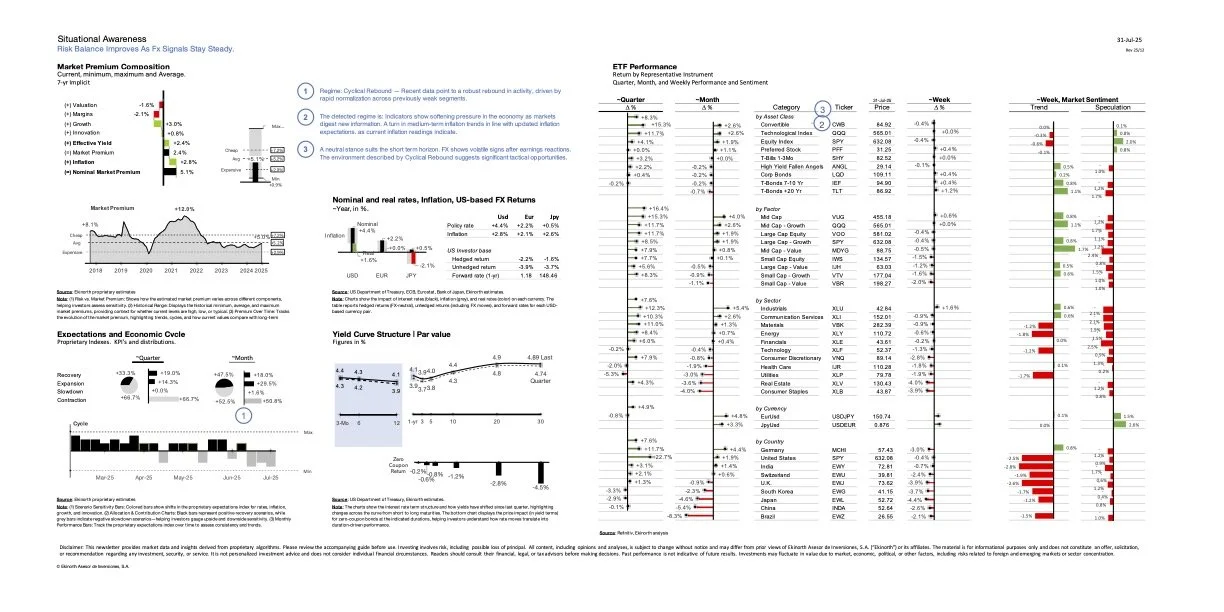

2025/07 Market Situational Awareness

Risk assets advanced selectively as growth resilience offset late-cycle signals. Equities delivered positive returns at the aggregate level, led by U.S. large caps and quality-tilted segments, while cyclicals stabilized following earlier drawdowns. Credit spreads remained contained, reflecting still-constructive risk appetite, though dispersion widened across regions and factors as investors became more discriminating.

Rates and FX reflected a recalibration rather than a regime shift. Treasury yields were range-bound with modest curve normalization, suggesting markets are pricing slower—but not recessionary—growth alongside gradual disinflation. The U.S. dollar softened marginally, supporting international and EM assets at the margin, while real rates continued to anchor cross-asset valuation discipline.